A real estate blog about Port Orange and The Greater Daytona Beach, Florida area.

Showing posts with label mortgage. Show all posts

Showing posts with label mortgage. Show all posts

Sunday, June 30, 2013

Alarming but not devastating…

"Most analysts don’t expect higher interest rates to hurt the housing recovery, though they do believe rising rates will help tamp down home-price increases."

http://lnkd.in/crpbBj

Thursday, June 27, 2013

How Interest Rates Affect The Housing Market…

"A basic understanding of interest rates and the economic influences that determine the future course of interest rates can help consumers make financially sound mortgage decisions, such as making the choice between a fixed-rate mortgage or adjustable-rate mortgage (ARM) or deciding whether to refinance out of an adjustable-rate mortgage."

http://www.forbes.com/sites/investopedia/2013/06/27/how-interest-rates-affect-the-housing-market/

Home prices trending upwards…

"The S&P/Case-Shiller home price index was up 12.1% in April, compared to a year ago, in the 20 top real estate markets across the nation. That was the biggest annual jump in prices in seven years. Prices climbed 2.5% from March, posting the biggest one-month rise in the 12-year history of the index."

"The S&P/Case-Shiller home price index was up 12.1% in April, compared to a year ago, in the 20 top real estate markets across the nation. That was the biggest annual jump in prices in seven years. Prices climbed 2.5% from March, posting the biggest one-month rise in the 12-year history of the index."

http://lnkd.in/xzTupM

Weekly housing economic data…

"Higher mortgage rates may dampen some housing market activity but the effect will be muted by the high level of buyer affordability, and home sales should remain strong."

http://lnkd.in/RbfSFwThursday, March 21, 2013

Economic data that some may find helpful…

The following article reports:

Low and stable inflation is placing downward pressure on fixed mortgage rates…

http://www.freddiemac.com/news/finance/index.html

|

| Source: © Freddie Mac |

http://www.freddiemac.com/news/finance/index.html

Valuable information…

8 Tips To Sell An Old Home To Young Buyers

Selling any home can be challenging, depending on the market. But if you have an old home and want to appeal to young buyers in their 20s and early 30s, you may need to take some extra steps...

bankrate.com

+%C2%A9+Ben+Salter+from+Wales.jpg) |

| © Ben Salter from Wales |

bankrate.com

What colors are you thinking about?

|

| ©Iroc8210 |

Improving signs…

Construction Job Gains a Sign of Positive Growth The Bureau of Labor Statistics recently released its February Employment Report, and the numbers are promising for the housing market.realtormag.realtor.org

Construction Job Gains a Sign of Positive Growth The Bureau of Labor Statistics recently released its February Employment Report, and the numbers are promising for the housing market.realtormag.realtor.org

A new credit score model may have benefits for you…

New credit score could help millions…

VantageScore unveiled a new credit scoring model that will potentially boost scores for many credit applicants and help establish credit for millions of people who previously had little or no credit history. money.cnn.com

|

| ©efariel |

Saturday, March 16, 2013

6 Questions to Ask Your Loan Officer Before Starting the Loan Process

blog.homes.com» No one likes unpleasant surprises, especially if you are going through possibly the largest purchase of your life…

Saturday, March 9, 2013

Interesting industry perspective…

Cheap home prices lure hordes of cash-wielding investors, causing a severe housing shortage in parts of the U.S. market…

http://www.reuters.com/video/2013/03/08/reuters-tv-investors-turn-housing-surplus-into-hous?&videoChannel=118058&videoId=241546456Questions to Ask Your Loan Officer…

Good questions to know…

6 Questions to Ask Your Loan Officer Before Starting the Loan Process | A Real Estate News & Tips...

6 Questions to Ask Your Loan Officer Before Starting the Loan Process | A Real Estate News & Tips...

Thursday, March 7, 2013

Home prices finally returning to normal…

Good to know…

Home prices are expected to increase by an average of 3.3% annually over the five years ending September 2017, reported Fiserv Case-Shiller.

Home prices are expected to increase by an average of 3.3% annually over the five years ending September 2017, reported Fiserv Case-Shiller.

Back In The Game!

Home Buyers With Foreclosures On Their Credit Get Back In The Game

http://www.realtor.com/blogs/2013/01/28/home-buyers-with-foreclosures-get-back-in-the-game/?utm_source=twitterfeed&utm_medium=linkedin

Wednesday, February 27, 2013

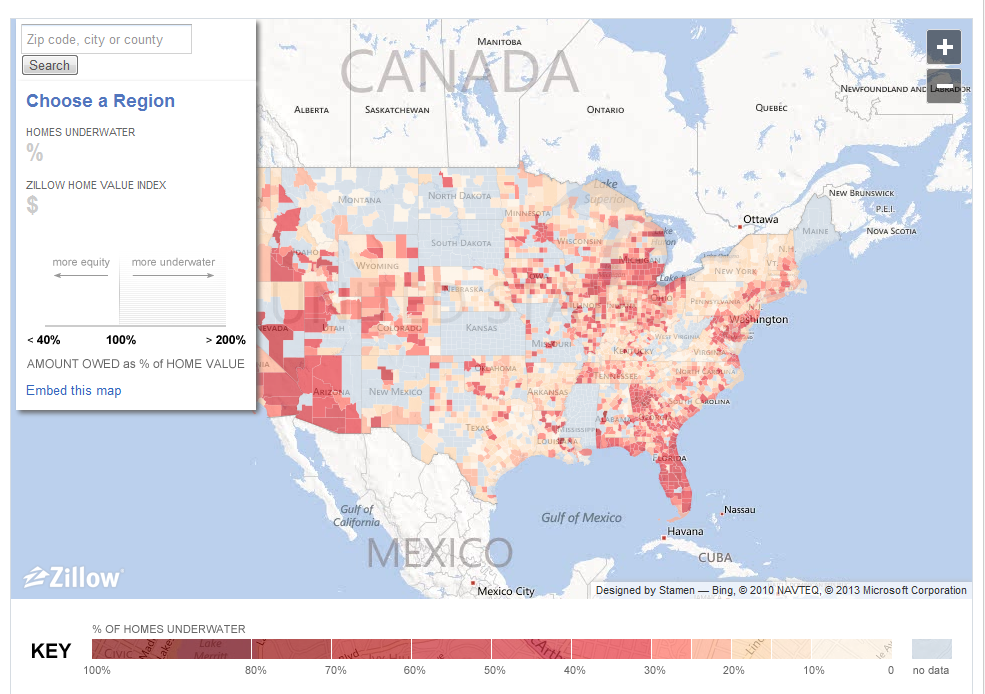

2 Million Homeowners Freed From Negative Equity in 2012; 1 Million More to Come in 2013

Now you know…

Almost 2 million American homeowners were freed from negative equity in 2012…

http://www.zillowblog.com/2013-02-20/2-million-homeowners-freed-from-negative-equity-in-2012-1-million-more-to-come-in-2013/

Almost 2 million American homeowners were freed from negative equity in 2012…

http://www.zillowblog.com/2013-02-20/2-million-homeowners-freed-from-negative-equity-in-2012-1-million-more-to-come-in-2013/

Sunday, February 17, 2013

Don't Obsess About Mortgage Rates…

When most people start shopping for a mortgage, the first thing they do is look for the lowest interest rate they can find. And that can get them into trouble. A low interest rate can save you money, obviously. But it's only part of the story.

http://realestate.aol.com/blog/2013/02/14/mortgage-rates?ncid=edlinkusreal00000002&ts=1360953953

Thursday, January 24, 2013

Home Selling Advice: What You Should Know About Today's Homebuyers…

Many parts of the country are seeing an uptick in real estate activity. We've been hearing for months now that buyers have returned; that it has become cheaper to own than to rent in many markets; and that sellers are realizing their once unsaleable homes may have a market.

If you're a seller, it's helpful to understand the mindset of today's buyer, to understand what they've been through and what they're willing to do -- or not do -- to get the home they want.

By Brendon DeSimone http://realestate.aol.com/blog/2013/01/22/home-selling-advice-know-buyers/

Saturday, January 12, 2013

FL releases info on state insurance companies

The Florida Office of Insurance Regulation (OIR) has released its 2012 Fast Facts report, created to give interested parties statistical data about Florida’s insurance market. The report compiles financial and regulatory information, insurance premium volume, number of domestic insurance companies and related entities, enforcement actions/consumer recoveries, public hearings and more.

http://www.floridarealtors.org/NewsAndEvents/article.cfm?id=285522

Friday, December 14, 2012

Top economists: FL’s housing market growing stronger, U.S. on same trend…

ORLANDO, Fla. – Dec. 12, 2012 – Florida’s residential real estate market will continue its upward trend into 2013, though the pace of recovery may be slower than the U.S. as a whole, according to leading U.S. economists speaking today at Florida Realtors® 2013 Real Estate and Economic Forecast Conference in Orlando. http://www.floridarealtors.org/NewsAndEvents/article.cfm?id=284687

Subscribe to:

Posts (Atom)